Elon Musk and others have been presaging doom inside business actual property, although oddly sufficient this pessimism just isn’t shared by nearly all of specialists surveyed just lately by Deloitte of their 2024 Business Actual Property Outlook Survey. That stated, there are causes to be bearish although these adverse indicators don’t counsel any disaster is imminent. The voices that proclaim one is looming are merely not wanting intently on the info; quite, they’re reflexively reacting to how uncommon the present actual property market is: In lots of people’s minds, unusual equals scary.

The business actual property alarmists are pointing to some actual financial elements that do counsel a contraction of kinds is within the offing: Nevertheless, they overstate their case and fail to contemplate mitigating elements. The elements most frequently cited are: 1) Excessive-interest charges, 2) the work-from-home revolution, 3) e-commerce, 4) normal recession fears, 5) monetary pressures shared by mid-sized banks and the quantity of mortgage debt turning over on workplace area in 2024. Let’s focus on these in additional element after which flip to a dialogue of things the pessimists are ignoring.

Excessive rates of interest

Properly, there isn’t a denying that rates of interest are excessive and that this collection of price hikes occurred extra shortly than another within the final thirty years (although, the 2004-2006 interval noticed a bigger whole enhance within the Federal Funds Price, a rise of practically 4% over that point). That stated, when Deloitte surveyed the CEOs of main business actual property firms, excessive rates of interest had been solely the fourth most severe concern they’d—with many extra rating impending inexperienced regulation as extra urgent.

Moreover, many property house owners are sitting on low-interest price loans that they’ll successfully, although not actually, switch to their new purchaser by promoting the property in a contract for deed deal. Contract for deed gross sales are primarily a rent-to-own relationship between the brand new purchaser and the vendor the place the vendor retains the deed on the property whereas permitting the brand new tenant to function and accumulate income from it, transferring the deed as soon as the funds are accomplished. Whereas single-family dwelling sellers want money now, house owners of business actual property can afford to interact on this kind of arbitrage.

This implies many house owners of business actual property have a tangible monetary asset they’ll leverage within the type of their excellent mortgages. Moreover, at current, the market expectation is that the Fed is extra probably than to not begin slicing rates of interest by March of subsequent yr. Lastly, the workplace buildings which can be most in danger, the centrally situated ones in downtown areas, are the exactly those which can be least prone to be mortgaged as a result of they’re usually older. After all, some variety of them are, however—as an entire—they’re extra prone to be absolutely owned.

The work-from-home revolution

I just lately wrote an article explaining how housing affordability considerations would pressure employers to just accept working from dwelling, at the least to a point. That stated, many workplaces are adopting a hybrid technique. Workplace area vacancies, whereas up, haven’t gone up catastrophically. The NAR has the speed climbing from 12.2% to 13.3%. Firms are additionally benefiting from the truth that work-from-home permits them to function with much less area to improve their workspaces—shifting to higher amenities in higher areas whereas leasing much less whole area.

So, it’s probably that solely the much less advantageous workplace area will probably be left with out tenants within the new equilibrium with everybody else upgrading; nonetheless, this area might be repurposed; certainly, the low-end workplace area might be extra readily repurposed than the high-end —being transformed into retail area, even condominium models, and even stand-alone housing: All of that are briefly provide. Certainly, the Deloitte Housing Survey discusses this flight to high quality workplace area, citing this hooked up article.

Equally, elevated e-commerce might cut back retail demand

That is true, however—in fact—e-commerce just isn’t totally new. Amazon has been round for practically 30 years, having expanded past books nicely over twenty years in the past. Nevertheless, a current examine by the ICSC entitled “The Rise of the Gen Z Client” reveals that the youthful technology nonetheless prefers brick-and-mortar buying. Ninety-seven p.c of respondents claimed that they most popular a brick-and-mortar expertise. So, if even probably the most internet-savvy technology prefers brick-and-mortar, it’s arduous to consider that e-commerce will displace it for its price benefits.

What’s extra probably is that e-commerce will come to dominate sure lessons of products, particularly staples (i.e., merchandise like detergent and cleaning soap the place you might be shopping for manufacturers you might be already conversant in) and electronics whereas brick-and-mortar will dominate others like clothes, items that individuals need to see earlier than shopping for. Certainly, accessible retail area is beneath regular ranges, and brick and mortar shops have seen development over the past two years whereas the job market stays tight that means that buyers have buying energy.

Moreover, as a result of it takes a very long time to get better one’s funding in a retail area, there’s a dearth of recent development happening now as traders wait to see how distant work and the e-commerce revolution play out. This implies changing failing workplace area into retail area will provide higher returns than it will if these areas needed to compete with new developments.

Recession fears

There are additionally fears that recession might push a business actual property market that’s dealing with challenges over the sting.After all, financial disaster is all the time attainable. Certainly, some indicators level to a possible recession: Deutsch Financial institution believes that the current price hikes depart the worldwide financial system inclined to shocks, primarily if something goes flawed, firms will be unable to “borrow their method out” as they did throughout the COVID-19 pandemic. It is a truthful level, however even this requires an exogenous shock—Deutsch Financial institution’s outlook report doesn’t level to any systemic financial imbalances like those who led to the 2008 Disaster.

“With the lagged influence of price hikes taking impact, we are able to already see clear indicators of information softening. Within the U.S., the latest jobs report confirmed the best unemployment price since January 2022, bank card delinquencies are at 12-year highs, and excessive yield defaults are comfortably off the lows,” Deutsche’s Head of International Economics and Thematic Analysis, Jim Reid, and Group Chief Economist David Folkerts-Landau stated of their newest report.

Current indicators

That stated, current indicators—just like the distinction between the 3-month and 10-year treasury yield (i.e. how shut we’re to yield curve inversion)—have tipped beneath the 50% mark in current months in line with Statista and, extra importantly, we stay at above full employment (economists take into account 5% unemployment the pure price, i.e. full employment, because the financial system requires folks to maneuver between jobs as a part of its regular functioning). Except the employment state of affairs adjustments significantly, a severe recession is unimaginable—and there’s fairly a little bit of slack within the unemployment rope: If there’s a recession, it is not going to be a catastrophic one.

The primary financial danger is that banks had did not correctly hedge towards period danger and that this might trigger a collapse of the US monetary sector (i.e. a discount within the worth of their T-bills and different bonds, that are usually thought of “secure”) has clearly handed: Even the least diligent danger officers ought to have adopted a way of coping with this by now, and with inflation falling we are able to assume the worst of the speed hikes are behind us.

Comming from small and mid-sized banks

Lending to business actual property builders and managers largely comes from small and mid-sized banks, the place the stress on liquidity has been most extreme. Moreover, a substantial portion of business actual property debt is coming due in 2024. About 80% of all financial institution loans for business properties come from regional banks. Pessimists consider banks are prone to pull again on business actual property commitments extra quickly in a world the place they’re extra targeted on liquidity.

That stated, even a cash-strapped regional financial institution would favor to refinance a mortgage on favorable phrases than to see the mortgage default. Nevertheless, you will need to remember that this definition of “small and mid-sized banks” refers to establishments with “a pittance of 250 billion {dollars} in property.” Given the fairness cushion provided by bigger down funds on business actual property loans, these establishments are a bit of extra strong than George Bailey’s financial savings and mortgage from “It’s a Great Life.”

Now that we’ve got mentioned the elements business actual property pessimists level to, let’s take into account some constructive indicators that I haven’t managed to say but:

Reshoring within the aftermath of Covid-19

The provision chain disruptions skilled throughout the COVID-19 pandemic which resulted from numerous nations’ totally different responses to the disaster have made many American firms put money into absolutely home manufacturing processes. This, in flip, means elevated demand for industrial actual property, a piece of the true property market many of the pessimistic articles popping out merely ignore. This sector will proceed to see strong development, offsetting among the downturns skilled within the workplace sector. After all, many actual property firms don’t maintain any actual property on this class, so particular person companies nonetheless stay uncovered to danger—however this silver lining shouldn’t be ignored. The next article gives some empirical help for the reshoring narrative.

Mortgage foreclosures are nonetheless low

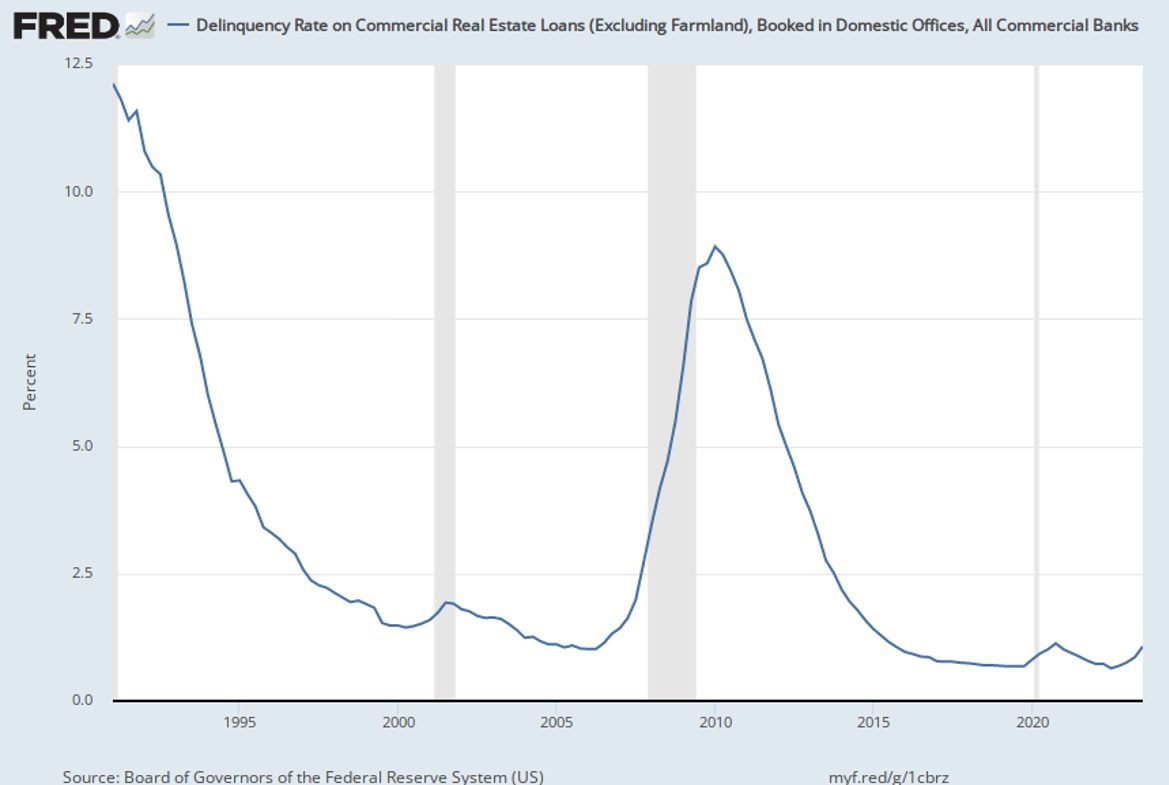

By historic requirements (even when Mezzanine loans, primarily bridge loans business actual property firms take out are at document highs, these “highs” are nonetheless within the vary of 66 loans whole). As you possibly can see beneath, delinquencies on business actual property loans are nicely beneath what they had been all through the 90s: A decade that I bear in mind fairly fondly and that by nearly all measures was a time of financial prosperity. After all, they had been equally low going into the disaster, however throughout the Disaster of 2008 there was extra happening—particularly weak employment numbers and large quantities of unhealthy single household mortgage debt. Business actual property can clearly be affected by a recession or melancholy, however there aren’t any examples of it being the main trigger of 1: The place of Elon Musk and the opposite Rooster Littles.

The position of the NAR

The NAR has famous that universities are displaying an curiosity in leasing workplace area to draw college students again to class. In main cities, the place workplace area is prone to take the most important hit and the place conversion is probably the most tough, this might assist to shore up flagging demand—even when it’s not an amazing issue.

In the meantime, residence rents are both regular or growing in most markets

Which means that builders of multifamily models must also be prepared to purchase out holders of underperforming workplace buildings. A good portion of these workplaces might be transformed into residences.

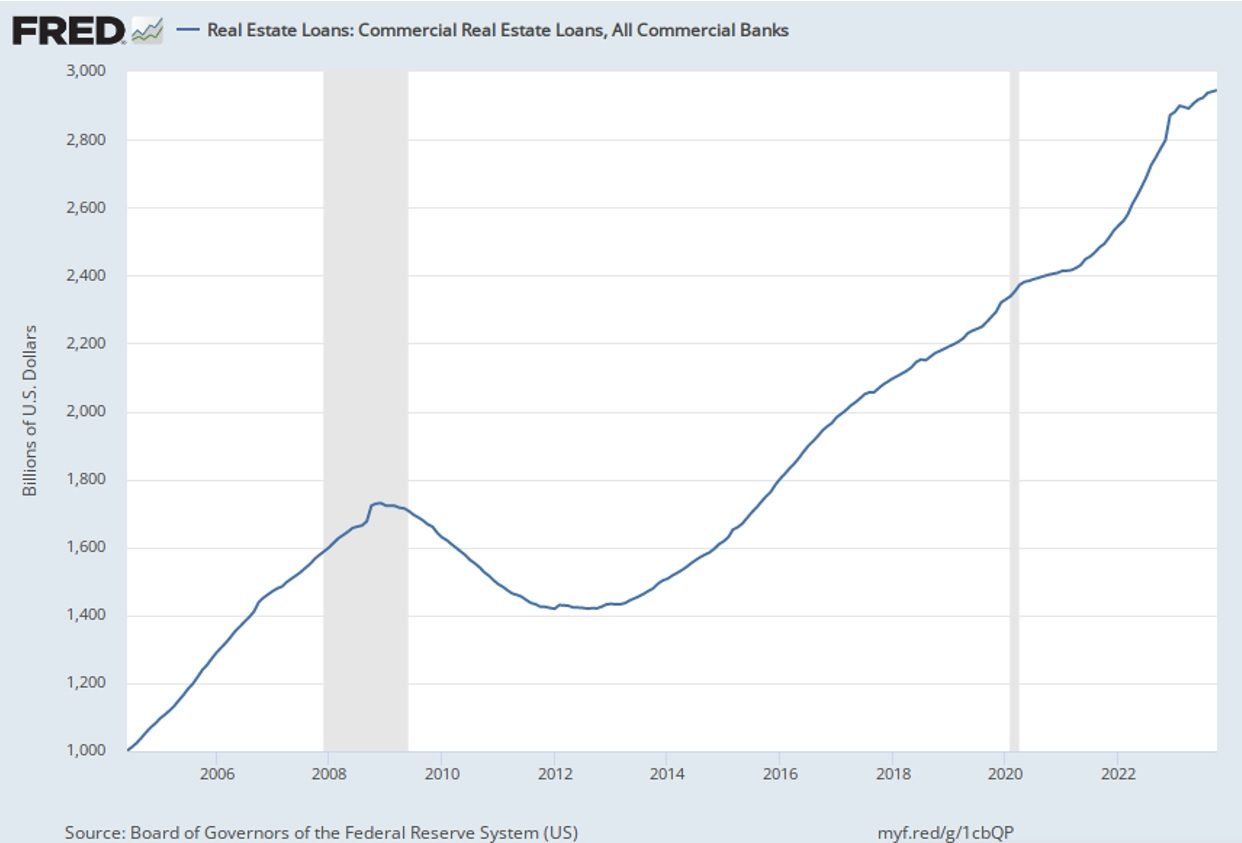

Banks are persevering with to make business actual property loans although it’s decelerating considerably

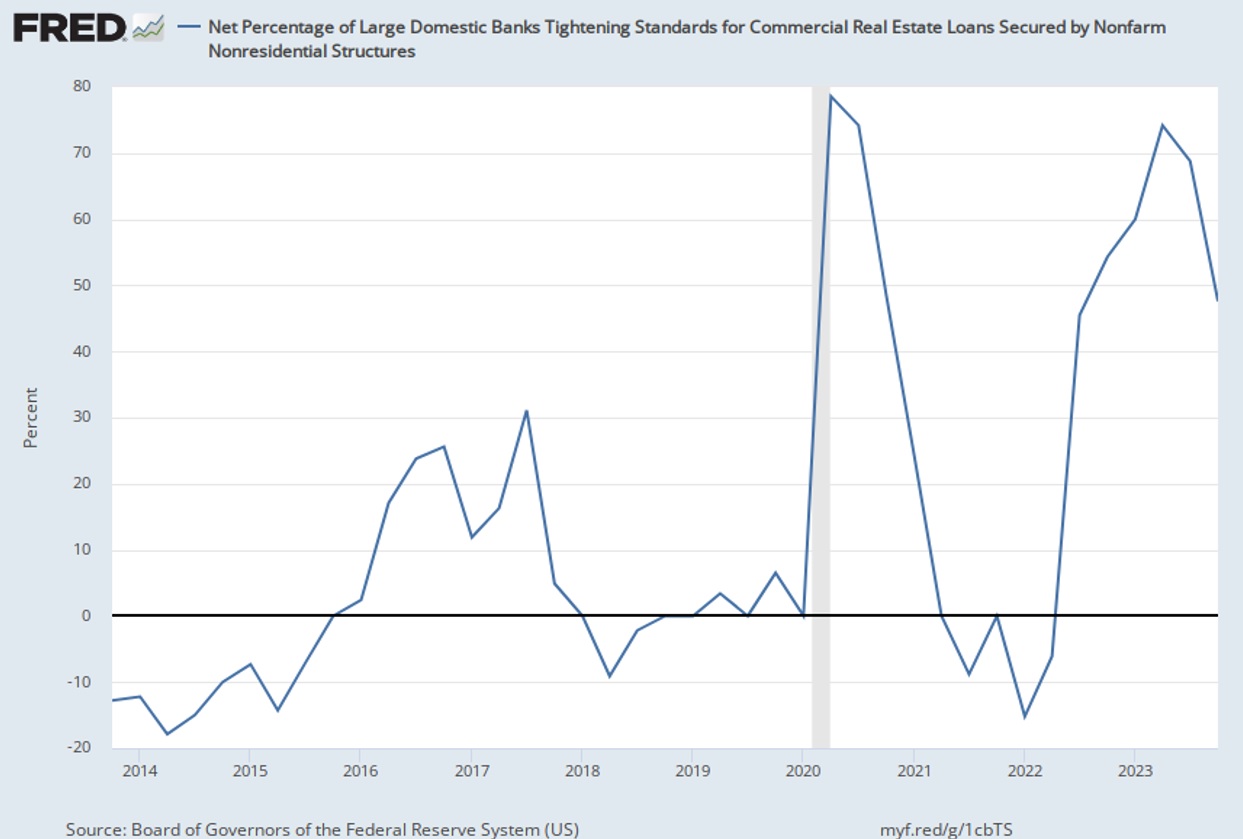

Moreover, it appears to be like like we’ve got already turned a nook on the tightening of lending requirements:

New workplace constructing development in metropolis facilities is at a low

In earlier booms, development exercise elevated going into the bursting of a bubble—with development exercise declining solely after a disaster started. Right here the absence of newly constructed provide means that common inhabitants pressures will finally reflate the market even when earn a living from home reduces demand within the quick run.

Whereas there’s purpose to be involved in regards to the workplace sector of business actual property, the worry that it’s going to set off a serious recession is overblown. In actual fact, there has by no means been a recession attributable to a bust within the business actual property sector. Some declare the 1990-1991 recession was attributable to this, however most individuals consider it was attributable to the shock to grease manufacturing ensuing from Saddam’s invasion of Kuwait and the following Gulf Warfare.

The excellent debt on business actual property loans are a fraction of excellent debt on single-family mortgages even once we embrace residences: And workplace buildings are only a fraction of that fraction, roughly 25% of the excellent business actual property debt. Moreover, business loans require a lot bigger down funds than single-family mortgages do—that means that you have to see appreciable depreciation earlier than a property proprietor would assume it higher to default on his mortgage than to simply promote his property.

Conclusion

Those that are panicking about business actual property merely haven’t acquainted themselves with the numbers concerned. If business actual property causes a recession, it is going to be a minor one, however a delicate touchdown each for the financial system and the business actual property sector usually appear more likely. That stated, when you do put money into business actual property, I’d steer clear of shopping for workplace area except you may have each unimaginable native data and profound causes to take action. The opposite sectors, esp. the economic sector, are prone to proceed performing nicely and can probably offset the losses within the workplace area sector.

Business Actual Property: A Localized Contraction, Not a Crash was final modified: December twelfth, 2023 by